We are pleased to announce Springboard 24.10 is now generally available. This release focuses on the new self-service Collections portal for LMS, and expands the existing Lending integration with LMS. Read on to find out more.

| Version | Date Released | New Features | Improvements | Fixes | Security | CVE |

|---|---|---|---|---|---|---|

| 24.10.0 | 20 December 2024 |

Collections

Collections is a new Springboard solution to provide a self-service portal for delinquent account holders to make a payment, schedule a payment, or schedule a call. This solution incorporates an integration with Temenos Lifecycle Management System (LMS). The payment option has been disabled pending LMS API enhancement. When enabled, Swivel will be the payment provider.

Lending + Retail DAO for LMS

This release includes the following improvements to the Lending + Retail DAO for LMS solution. To learn more, see the Springboard for LMS Functional Guide.

- Enhanced the existing Lending journey flow and integration with LMS.

- Added Credit Union eligibility and membership share logic to the Lending journey flow.

- Enabled retail DAO journey flow for LMS integration.

- Enabled Lending + Retail DAO journey flow for LMS.

Supported product types

This Springboard release supports a limited set of product types for the LMS integration solution. These are standard products, requiring the applicant to be 18 years of age and limited to two applicants on the application.

| Consumer Deposits | Consumer Lending |

|---|---|

|

|

Supported features

The Lending + Retail DAO for LMS solution supports the following features in this release.

- Primary and joint applicant

- Deposit account opening

- Loan application

- Loan application + deposit account opening

- Prefill applications with Prove or Mitek

- CU eligibility

- Automatically add CU member share to any application type

- Enable ID Details (enabled by default)

- Enable Mother’s Maiden Name and Marital Status (both enabled by default)

- Address history

- Employment history

- Deposit account beneficiary

- Funding new deposit accounts or CU member share

Unsupported features

This release limits the features available in some Springboard solutions. If you enable these features in LMS, custom development will be required in Journey Manager and Springboard. More features will be added throughout 2025.

- Any product types not listed above

- Stipulations for deposit accounts

- Cross-sell opportunities for deposit accounts

- Multiple phone types

- More than two applicants

- Entity as an applicant or deposit account beneficiary

- Loan repayment options

- Multiple current jobs

- Applicant types other than primary, joint, and beneficiary

- Loan proceeds to a non-applicant entity or via multiple distribution methods (for example, check and direct deposit)

- Existing customer journey

Retail DAO

We have improved the reminder email service and functionality based on feedback from implementation teams and clients.

Reminder Emails

Reminder emails are designed to remind applicants to come back and complete saved application. These emails are triggered when an application is auto-saved or manually saved by the applicant.

Reminder email variable interval

Previously, the configuration for reminder emails was a set interval for all reminders sent to an applicant. The result was reminder emails arriving in the applicant inbox at the same time every day. Based upon client feedback, we have updated the configuration to allow for the reminder emails to be sent at different intervals.

The following table identifies the reminder email configuration changes introduced in this release.

| Property | Type | Description | Example |

|---|---|---|---|

formCodes |

CSV |

A comma-separated list of forms to send reminder emails. |

|

notifWaitTime |

|

Delay before sending out first each notification using the format described in Reminder Schedule Format Strings below. |

|

reminderFrequency |

|

|

|

|

|

|

|

|

|

|

|

Where to find the email address in the |

|

|

|

CSV |

A comma-separated list of scheduled times between reminders using the format described in Reminder Schedule Format Strings below. |

|

- The

reminderFrequencyandmaxRemindersproperties are no longer applicable to this service. - The updated service sends reminder emails according to the periods defined in

reminderSchedule. notifWaitTimenow defines an arbitrary time to wait, as a grace period, before sending out each reminder.

Reminder Schedule Format Strings

The amount of time to wait between reminders is configured using a human-readable text format. The format supports 4 time units.

| Unit | Symbol |

|---|---|

|

Days |

d |

|

Hours |

h |

|

Minutes |

m |

|

Seconds |

s |

You can use any combination of these 4 units to create a reminder schedule interval. For example, if you want the system to wait 1 hour and 45 seconds before sending out the first reminder, enter 1h 45s as your value.

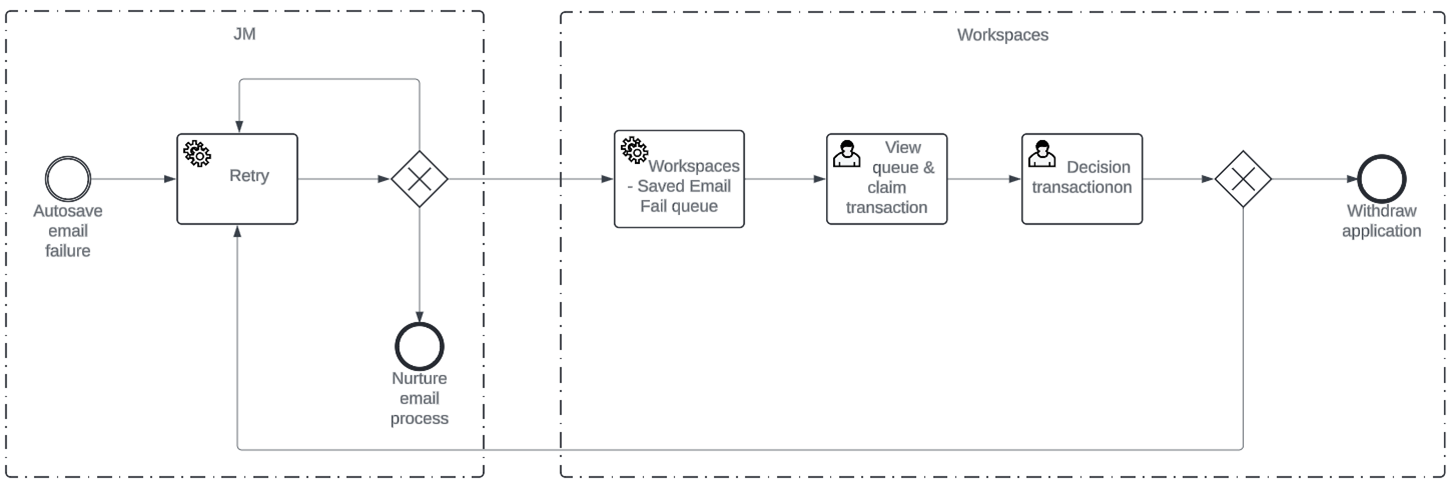

Saved email failure

Resolved an issue where the auto-save email failed to be sent, causing the subsequent reminder emails not to be sent.

Should this scenario occur, the email is flagged and the service attempts to send the saved email up to three times. If the saved email continues to fail, the application appears in Workspaces under Email Errors. Here, bank staff can attempt to resend the email or withdraw the application. The same team members who can decision an application will be able to see and act on these applications.

Workspaces

Applications where the saved email has reached the failed attempts limits can be found under the new Email Errors space.

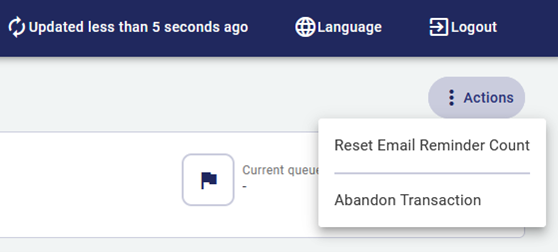

On viewing the application, the user can action the application by resetting the reminder count or abandoning the transaction. When the email reminder count is reset, the reminder service picks up the transaction and attempts to send the email.

Payroc

The Payroc integration has been updated per a request from Payroc and only impacts new customers. Existing customers have continued support from Payroc and may continue using their connection and agreement.