Springboard solution: Lending

SpringboardThis topic is related to Springboard. | Form Builder | 23.10This feature was updated in 23.10 Lending 1.1This feature was updated in Lending 1.1.

The Lending Springboard solution for US loan and credit card applications is a ready-to-use solution based on standard Springboard to enable onboardingThe steps required to get a new customer integrated into a new program. These steps may vary business to business. of new and existing customers for US auto loans, personal loans, and credit cards. The Springboard Lending solution comes pre-integrated with Temenos LMS.

Standard Springboard

Springboard solutions enable US banks to deliver an outstanding digital customer acquisition journey rapidly, using a ready-made solution on an extensible platform that grows with the financial institution.

The following information can help you to learn about standard Springboard.

Application Flow

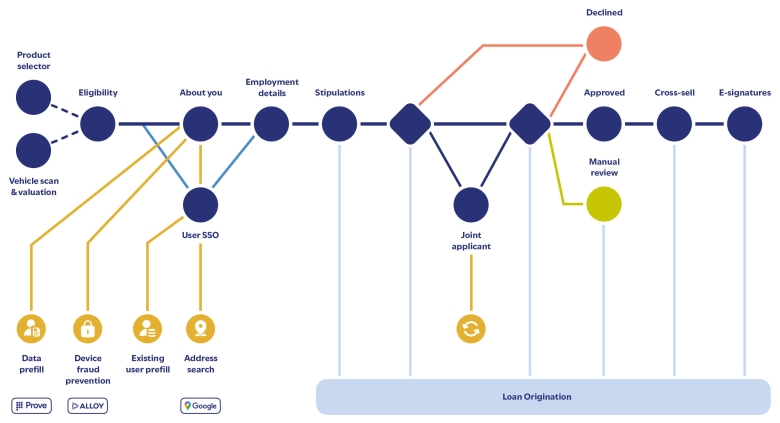

A typical application flow for a Lending Springboard solution is shown below.

Altering this application flow is a customization.

Use cases

The following use cases are supported by the Lending solution.

- Select products: Review available products, then select one or more to apply for before continuing to the DAO application.

- Apply for new loan: Apply for a new personal loan using a mobile or desktop device.

- Auto-approve: Automatically approve applications based on data collected and information from third party vendors.

- Auto-decline: Automatically decline an application based on data collected and information from third party vendors.

- Manual review: Automated decision rules may send applications to a manual review workflow where they may be approved or denied.

- Manual approve: Manually approve applications based on data collected and information from third party vendors.

- Manual decline: Manually decline an application based on data collected and information from third party vendors.

- Resume application: Resume an application after it has been saved or manually approved.

Lending components

The Springboard Lending solution comprises multiple components, all of which work together to provide the required functionality. To learn about how these components relate to one another and interact in a Springboard solution, see Springboard solution architecture.

In addition to forms and Exchange services, the components used by the Lending Springboard solution are:

- Journey Narrative

- Decision Engine

- US Lending Project

- Workflow (Collaboration Jobs) and Testing Form

- Maestro template

Forms

Every Springboard solution is comprised of several forms, each of which represents a different chunk of functionality. The following forms are used by the Lending Springboard solution.

- Product Selector Form (optional)

- Lending Form

- Email Unsubscribe Form

Exchange services and third-party integrations

The following Exchange services are used by the Lending Springboard solution.

Choosing to utilize different third parties other than those listed below is a customization.

- Alloy: Provides fraud detection using device signatures and metadata. Also provides personal fraud risk.

- Amazon SNS: Performs multi-factor authentication using SMS when resuming applications.

- Google Places: Provides autocomplete address suggestions to select from as an applicant types an address.

- iovation: Provides fraud detection using device signatures and metadata.

- Mitek License Pre-fill: Prefills applicant data using driver license. May be used instead of or as an alternative to Prove Pre-fill.

- Prove Pre-fill: Prefills applicant data using mobile phone number and last four digits of applicant SSN.

Implementing a Lending solution

While substantial portions of a Springboard Lending solution are pre-built, client-specific work is still required for every implementation. Typically, the bulk of the client work is focused into three main areas:

- Configuration/Setup: Define style/brand, products, and other configurable options. Deploy and test components, and test integrations.

- Core Banking Integration: Supports account and customer creation, and other critical onboarding activities.

- Customization: Specific modifications to the project scope, added to the project statement of work (SOW) or via change requests (CR).

To learn more, see What clients need to know.