Springboard solutions

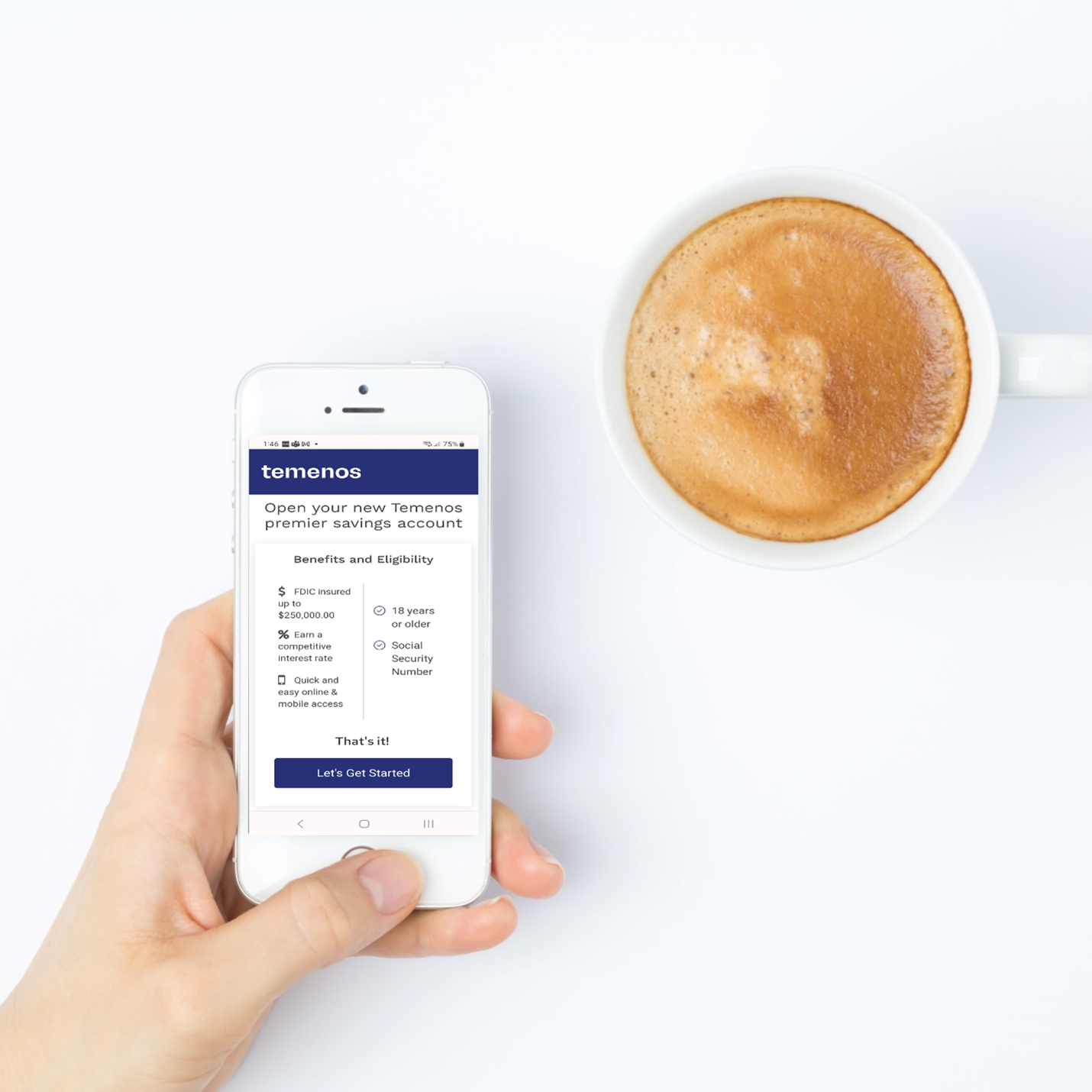

The Temenos Journey Springboard solutions for deposit account opening (DAO) and lending enables US banks to rapidly deliver an outstanding digital customer acquisition journey using a ready-made solution on an extensible platform that grows with the financial institution.

Springboard solutions offer a quick path to market, requiring configuration only. This is achieved by pre-building many of the typical components required to support US DAO solutions on the Temenos Journey Manager platform, and providing extensive configuration options for these components. Examples of pre-built components include an optional product selector, a Maestro template and forms, functions including third-party integration, and a standard workflow or collaboration job that supports manual review and decision-making.

The Lending solution is pre-integrated with the Temenos Lifecycle Management Suite (LMS), enabling LMS customers to go to market quickly with a lending solution for personal loans, credit cards, and auto loans. The same pre-built components and configuration options in the US Springboard DAO solutions are available in the US Springboard Lending solution as well.

Outstanding customer experience

- Springboard solutions offer exceptional customer experiences with industry-leading best practices, proven by top tier world-class banks.

- Springboard DAO captures the benefit of years of experience delivering best practices for customer acquisition journeys.

Speed and agility

- Get to market faster with acquisition journeys using pre-built solutions that run on the Journey platform.

- The platform provides agility to respond to future market changes and connect to the latest innovations in account opening experiences as they emerge.

Integrated compliance and risk management

- Springboard solutions solve the complex challenges of product selection during the deposit account opening process, such as compliance and risk management requirements.

- Using pre-integrated connections with proven fintech providers, our solutions address the critical issues of fraud screening, ID verification, risk mitigation, data pre-fill, and funding of new deposit accounts.

Omnichannel experience

- Deliver an outstanding customer experience across devices, screen sizes, and channels.

- Enable customers to start an application in one channel and complete in another.

- Increase conversions by allowing call center and branch staff to access abandoned applications and follow up to completion.

"Springboard Deposit Account Opening gives financial institutions a digital account opening and onboarding solution prebuilt with best-in-class customer experience and Fintech integration. The integrations with 3rd party Fintech service providers that can qualify and decision applications coupled with an extensible platform provides financial institutions the flexibility to deliver a differentiated customer experience."