In part 5 of 10 we look at the path of least resistance.

To open a bank account or originate a loan, there’s information you need – some of it for Risk reasons, some of it for Compliance reasons. Regardless of the reason, you need that information.

Providing that information takes time – typing it in is reasonably slow and whilst each individual field isn’t an issue, in aggregate it can take from 5 to 30 minutes to complete an application, depending on the product. And your customers have other things they’d much rather be doing with that time.

So we’ve seen banks invest in building experiences that can streamline the application process for consumers with capabilities like:

- Photo ID capture and prefill

- Prefilling information from a mobile/cell carrier

- Prefilling information from an existing banking partner through account aggregation or open banking APIs

- Etc.

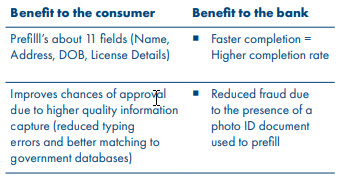

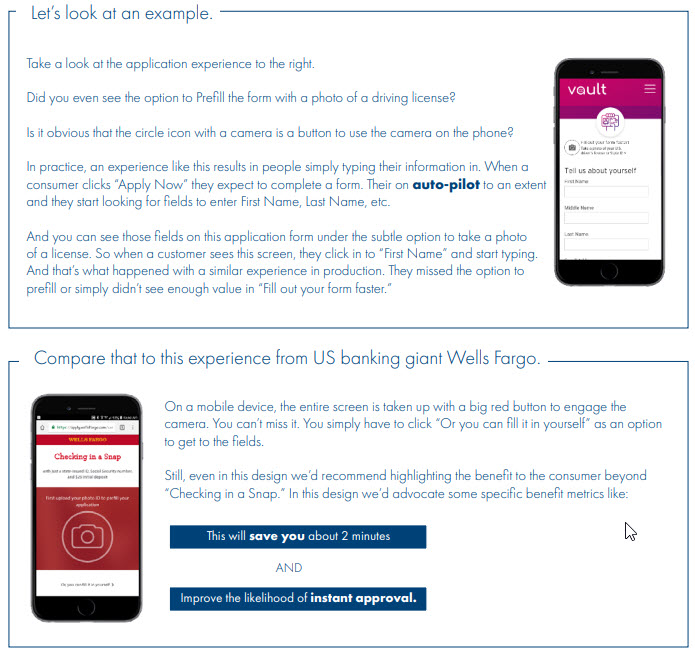

However, when these experiences aren’t positioned appropriately with customers, they’re often ignored or simply missed. The benefits (to the consumer!) of using these services should be promoted to encourage customers to leverage these services. It will save them time AND it will help you get more completed applications for accounts, cards, loans. For example, with photo ID capture.

But very often the expedited process is presented along with the option of just typing information in. And in fact, it’s often missed! Therefore the customer just starts typing information in, which takes time, and then they abandon due to fatigue, or they get distracted because it’s taking too long, and so on.

In Part 6 we look at asking tough questions last.