In this 1st article of our 10 part onboarding series, we look at different paths to purchase different products. It's not one size fits all.

Have you ever used Amazon 1-Click to make a purchase? It’s hard to deny the beauty in the simplicity of the experience. You save your preferred delivery address and purchase method, and then you can buy things with a single click.

In the world of ecommerce in 1999, this was such a revolutionary design that Amazon was awarded a patent for 1-Click which stood until September 2017. Meaning, Apple paid a royalty to Amazon for every iTunes purchase made by consumers using Apple’s version of 1-Click.

But with such a revolutionary design, did Amazon do-away with the Shopping Cart? No! Amazon recognized there were different paths to purchase and offers both Shopping Cart and 1-Click. For example:

- I want to buy a cover for my new smartphone, 1-Click is perfect.

- I want to buy presents for the kids for Christmas, but realize I should run this by my wife. I put the items in my shopping cart and we agree on what stays before we place the order.

Amazon has further emphasized the need for different paths to purchase with the launch of Amazon Go stores and the purchase of the Whole Foods Market chain in the US. When you’re hungry at lunchtime, even the speedy 2 hour Amazon Now! delivery times won’t satisfy an empty stomach quick enough. In the world of ecommerce, there’s still a place for traditional stores and even the world’s largest online retailer recognizes that.

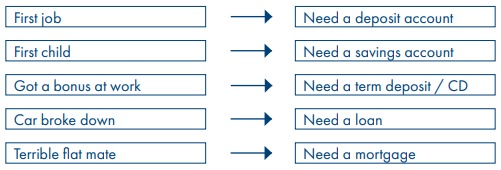

So what’s that got to do with banking? Every bank would like to think that customers don’t just want “a product,” they want a financial partner. And in some cases, this is true – and these are extremely valuable customers. But for many (if not most) customers, their primary need is typically a product. And that product need is driven by a life event.

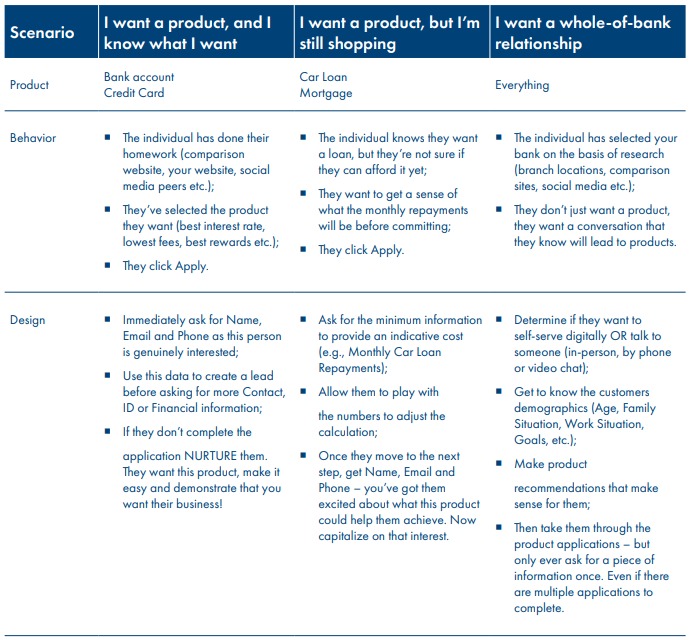

In some cases, the customer has already done their research on a product comparison website, and they know what they want. In other cases (especially for loans / mortgages) the customer may still be shopping – trying to determine if they can afford the car loan or mortgage.

However, there are still scenarios where the customer does want a bank as a whole, not a single product. Perhaps they’ve moved house. Or they want to break-up with their current bank due to poor service or bad PR recently. So when looking at customer acquisition, we encourage you to design around three different use cases to create compelling purchase experiences that align to how consumers want to buy.

I know this can appear that you’re building varied acquisition experiences – but this is not where you want to save money by building something that’s easy for you to maintain. You’ve invested a lot in marketing to get the customer to this point…make the next step perfect. Whether that’s 1-Click, a shopping cart or a store … make it perfect.

In Part 2, we'll look at improving completion rates.